Indexed Universal Life Insurance: What Are Volatility-Controlled Indexes?

In addition to providing a death benefit, indexed universal life (IUL) insurance offers the potential to grow the value of your policy based on the performance of a market index.

National Life Group IUL policies offer the option to link the potential growth of your policy to a volatility-controlled index.1

All our IUL policies offer downside protection with a zero percent floor — the least interest you are ever credited is 0%.

But when you opt for a volatility-controlled index, any cash value growth may also be smoother than with a traditional index like the S&P® 500.

A volatility-controlled index may be ideal if you are looking for more gentle ups and downs but still want the interest-crediting potential provided by Indexed universal life insurance.

Key things to know about indexed universal life insurance and volatility-controlled indexes:

- The potential growth of the cash value of an indexed universal life insurance policy is based on the performance of a volatility-controlled index or a traditional market index like the S&P 500.

- Indexed universal life insurance policies aren't directly invested in a market index.

- Indexed universal life insurance offers protection when the market goes down.

Why are there volatility-controlled indexes?

Up or down, market volatility is the only certainty. You can avoid volatility by choosing conservative financial products that offer guaranteed returns, independent of how the markets are doing.

But if you want to get some of the gains of the markets over time, exposure to volatility is inevitable.

Volatility-controlled indexes aim to reduce how much volatility you are exposed to. These indexes still will have ups and downs like the stock market, but they aim to deliver a smoother ride than if your IUL cash value growth was based on the performance of a traditional index like the S&P 500.2

How are volatility-controlled indexes designed?

Volatility-controlled indexes use a variety of asset classes, including stocks, bonds, real estate, commodities, and cash. Some use U.S.-only assets, other indexes also include global assets.

By adjusting the mix as needed, the index looks to manage volatility over time.

What volatility-controlled indexes can I choose from?

Different indexed universal life insurance products use different indexes.

National Life Group IUL policies offer a choice of two volatility-controlled indexes:

- US Pacesetter Index

- Balanced Trend Index

Both indexes guarantee:

- A participation rate of 50% or higher

- No cap — how much interest you can earn in a period is solely based on index performance and isn’t limited

- A zero percent floor

What is the participation rate?

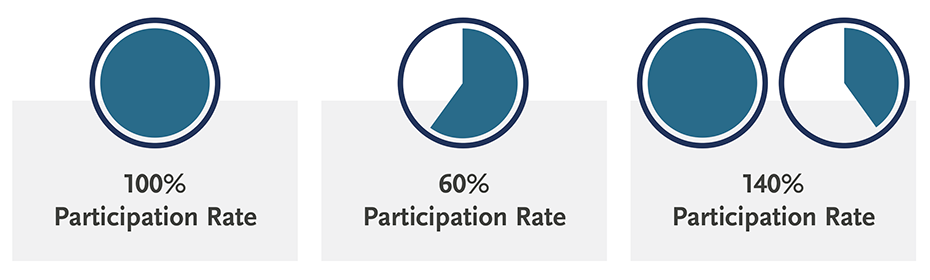

The participation rate determines how much of the market index gains are credited to your policy.

Here are examples illustrating how interest is credited for a specific time period (known as “point to point”), which can be one or two years:

- If the market index gained 8.00% and the participation rate is 140%, you would get credited 11.20% if there is no cap.

- If the market index gained 8.00% and the participation rate is 60%, you would get credited 4.80% if there is no cap.

- The participation rate can also be 100%. In that case, you would get credited at the same rate as the market index gain if there is no cap.

What index should I choose?

With National Life Group IUL policies, you can choose between traditional indexes (like the S&P 500) and volatility-controlled indexes. You can also opt to put some money into a fixed account with a guaranteed interest rate.

What index is best for you depends on your objectives and risk tolerance.

You can also choose to allocate money across the different options.

Learn more about your interest crediting options and view historical returns.

How do I change my allocations if I already have a National Life Group IUL policy?

You can change your allocations using the National Life Group customer portal or via our app.

Download the customer app

Next steps?

- View the differences between interest crediting options and historical performance

- Find out what is best for you and your unique situation: Work with your agent or a financial/tax professional.

1A low volatility index aims to deliver a narrower range of outcomes: more certainty at the expense of less upside and downside. When included in a fixed indexed annuity or life insurance product with the protection of a 0% floor, the benefit of reduced downside will not be realized for index returns below 0%. A cap may not be imposed on the indexed interest that can be earned. However, the index deducts a maintenance fee to cover expenses, costs and fees. Contract value is not impacted by the maintenance fee. This fee may be increased or decreased in the aggregate by the volatility control mechanism. While the volatility control may result in less fluctuation in rates of return as compared to indexes without volatility controls, it may also reduce the overall rate of return as compared to products not subject to volatility controls and the Index may underperform similar portfolios from which these fees and costs are not deducted. Indexed life insurance products do not directly participate in any stock or equity investments. The index strategies of fixed indexed life insurance policies credit interest based in part on the change in a market index such as this one. For an Index with volatility control and additional costs deducted from the Index value, the positive Index value change may be less than that of similar indices that do not include volatility control and do not deduct these costs. This may result in less interest that will be credited. When included in a fixed indexed life insurance policy with the protection of a 0% or 1% floor, the benefit of reduced downside will not be realized for index returns below 0% or 1%.

2There is no guarantee that a volatility-controlled index will achieve its objectives.

TC7517276(0125)3