Indexed Annuities: What Are Performance Trigger Strategies?

Some index annuities, like National Life Group’s flexible premium and single premium indexed annuities, offer a performance trigger index crediting strategy.

Key things to know about performance trigger strategies and indexed annuities:

- The potential growth of the cash value of an indexed annuity is based on the performance of a market index like the S&P 500.1

- Indexed annuities aren't directly invested in a market index.

- You typically have a choice of multiple crediting strategies. One option may be a performance trigger strategy.

- The performance trigger strategy will credit a fixed interest even if the market value growth is 0.00%.

What does it mean that cash value growth is based on index performance?

The potential growth of an indexed annuity is typically based on the performance of a market index in a given period (usually over a one- or two-year period).

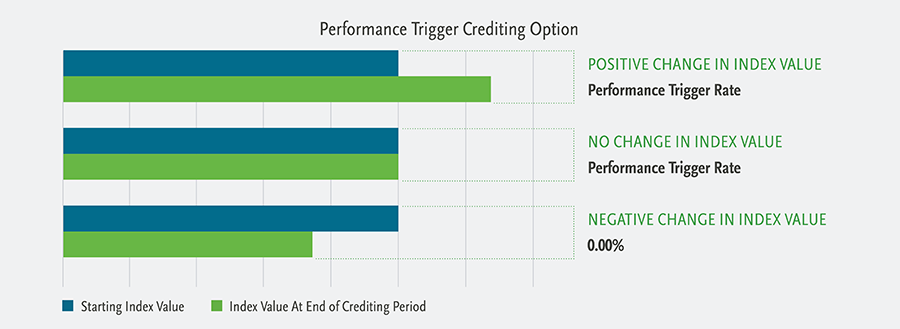

How does the performance trigger strategy work?

With the performance trigger crediting strategy, your policy is credited based on a fixed interest rate if the change is not negative. For example, if the performance trigger rate is 7.00%, you’d get credited 7.00% as long as the value of the index did not decrease.

If the market index value went down, you will be credited 0.00%. So, you will never lose a penny of your deposits and earned interest — any gains are locked in. You can never lose interest previously credited.

I have a National Life Group indexed annuity. Can I change strategies?

Yes, you can change index strategies at any time. Your new strategies will take effect at the beginning of the next crediting period. You can change your allocations using the National Life Group customer portal or via our app.

DOWNLOAD THE CUSTOMER APP

Next steps:

- Learn more about indexed annuities and index crediting.

- Find out what is best for you and your unique situation: Work with your agent or a financial/tax professional.

1The "S&P 500" is a product of S&P Dow Jones Indices LLC or its affiliates ("SPDJI") and S&P Opco, LLC and has been licensed for use by Life Insurance Company of the Southwest (“LSW”). Standard & Poor's® and S&P® are registered trademarks of Standard & Poor's Financial Services LLC ("S&P") and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (''Dow Jones"). The trademarks have been licensed to SPDJI and have been sublicensed for use for certain purposes by LSW. These fixed indexed annuities (“the Product”) are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, any of their respective affiliates (collectively, "S&P Dow Jones Indices"). Neither S&P Dow Jones Indices nor S&P Opco, LLC make any representation or warranty, express or implied, to the owners of the Product or any member of the public regarding the advisability of investing in securities generally or in the Product particularly or the ability of the S&P 500 to track general market performance. S&P Dow Jones Indices and S&P Opco, LLC’s only relationship to LSW with respect to the S&P 500 is the licensing of the Index and certain trademarks, service marks and/or trade names of S&P Dow Jones Indices and/or its licensors. The S&P 500 is determined, composed and calculated by S&P Dow Jones Indices or S&P Opco, LLC without regard to LSW or the Product. S&P Dow Jones Indices and S&P Opco, LLC have no obligation to take the needs of LSW or the owners of Product into consideration in determining, composing or calculating the S&P 500. Neither S&P Dow Jones Indices nor S&P Opco, LLC are responsible for and have not participated in the determination of the prices, and amount of Product or the timing of the issuance or sale of the Product or in the determination or calculation of the equation by which the Product is to be converted into cash, surrendered or redeemed, as the case may be. S&P Dow Jones Indices and S&P Opco, LLC have no obligation or liability in connection with the administration, marketing or trading of the Product. There is no assurance that investment products based on the S&P 500 will accurately track index performance or provide positive investment returns. S&P Dow Jones Indices LLC is not an investment advisor. Inclusion of a security within an index is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such security, nor is it considered to be investment advice.

NEITHER S&P DOW JONES INDICES NOR S&P OPCO, LLC GUARANTEES THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE S&P 500 OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES AND S&P OPCO, LLC SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES AND S&P OPCO, LLC MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY LSW, OWNERS OF THE PRODUCT, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P 500 OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES OR S&P OPCO, LLC BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND LSW, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

TC7810304(0425)3