What is a Life Insurance Loan And How Can You Get One?

Permanent life insurance primarily is meant to provide death benefit protection. But with a permanent life insurance policy, you can also grow its cash surrender value, tax deferred (which means that cash surrender value may grow more quickly than if you had to pay taxes on gains every year).

You may be able to take a life insurance loan using the cash surrender value of the policy as collateral.

Key things to know about life insurance loans:

- A life insurance loan provides access to the cash surrender value of your permanent life insurance policy.

- Your policy needs to have sufficient cash surrender value before you can take a loan.

- You’re not taking money out of your policy but borrowing against your policy.

- A life insurance loan may be more affordable than other types of loans — such as car loans, home equity loans, and student loans— or racking up credit card debt.

- There are several types of life insurance loans you may be able to choose from.

- You can use life insurance loans as a source of income during retirement.

- You don’t need to get approval to take a loan.

- A life insurance loan reduces the policy’s cash surrender value and death benefit until fully paid back.

- The loan is not taxable as long as the policy stays in force. There could be tax ramifications if the policy lapses or you surrender the policy.

Ready to take a life insurance loan?

Use our mobile client app or online customer portalOpens in new Tab to initiate a loan (up to $50,000).

Can you take a loan against your life insurance policy?

Yes - if you have permanent life insurance and sufficient cash surrender value that can be used as collateral.

All types of life insurance provide death benefit protection, but only permanent life insurance offers the ability to build cash surrender value.

A life insurance loan provides access to that cash surrender value — you have the right to borrow money from your insurance company using your policy cash surrender value as collateral for the loan.

This is one of the reasons why it’s important to sufficiently fund your permanent life insurance policy: If you build cash surrender value now, you can take a loan from your life insurance in the future.

Life insurance loans are not available with term life insurance policies. If you have a term life insurance policy, consider converting to permanent life insurance if being able to borrow against the cash surrender value of your life insurance policy may be important to you in the future.

You don’t need approval to take a life insurance loan.

What is the loan value of a life insurance policy?

How much you can borrow depends on the current cash surrender value of your cash policy, which will be used as collateral if you take a loan.

This cash surrender value is different from the death benefit, or face amount, which is the money your loved ones get when you die. When a policy is referred to with a dollar amount (for example, “a $1 million dollar policy”), that amount reflects the death benefit, not the cash surrender value of the policy.

The cash surrender value of your policy is lower than the death benefit — it’s the accumulated value of your policy based on premiums and credited interest, minus any fees and deductions.

To grow your cash surrender value and ensure that your policy won’t lapse, make sure to make premium payments that are higher than the Monthly Minimum Premium.

Benefits of taking a loan against your insurance policy

A life insurance loan provides access to the cash surrender value you have built up, income tax-free1. In addition, benefits of a life insurance loan include:

- Guaranteed approval if you have enough cash surrender value.

- You can use the borrowed money for any purpose, for example to buy a new car, remodel your home, or fund educational expenses.

- Competitive loan interest rates.

- With a participating loan, your accumulated value may be keep earning interest credits, because you are borrowing against it, not withdrawing from your policy. You can repay the loan, in full or in part, on your own timeline.

- You don’t have to pay the life insurance loan back if you don’t want to. (You will need to pay sufficient premiums to keep the policy in force and your benefits will be reduced by outstanding loans at death.)

1Requires the policy to stay in force. Taking a life insurance loan will reduce the accumulated value of your policy upon surrender, and reduces the death benefit upon death. Except in the case of a Modified Endowment Contract (MEC), withdrawals up to the basis paid into the contract and loans thereafter will not create an immediate taxable event, but substantial tax ramifications could result upon contract lapse or surrender. For MECs, contract loans and withdrawals are considered taxable income.

In addition to the death benefit, life insurance loans can help provide financial flexibility

![]()

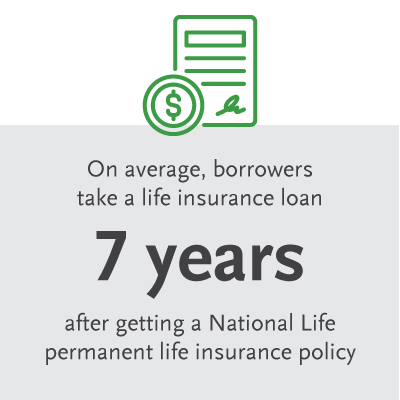

When you can take a loan

Loans are available at any time after the first policy year (and may be available earlier if there is sufficient cash surrender value).

However, it can take many years to build up significant cash surrender value in a permanent life insurance policy. In the early years of the policy, there may be little value, if any, to borrow against.

The cash surrender value of your policy is lower than the death benefit — it’s the accumulated value of your policy based on premiums and credited interest, minus any fees and deductions.

Paying more in premiums into your policy helps you accumulate more cash surrender value.

You can get your funds quickly

If you have sufficient cash surrender value, you have the right to borrow against your policy. You don’t need to go through an approval process. It may take up to 3-5 business days to process your request once we have all necessary information.

The quickest way to initiate a life insurance loan is using the mobile client app

or online customer portalOpens in new Tab.

Loan types and rates

Depending on the type of permanent life insurance, you can choose between different loan types, each with different types of interest rates. Some loan types offer a fixed rate, other loan types charge a rate that varies based on an external economic index.

Indexed Universal Life (IUL) insurance policies offer participating loan options where your loan collateral remains in one or more index crediting strategies (as allocated) — offering the potential to earn indexed interest credits even on the loan amount. (This is not the case for a Participating Fixed Loan, where loan collateral is moved into an indexed loan account, with only one available index strategy.)/p>

You will see the loan interest rate that is in effect for your policy when you initiate a loan in the mobile app or on the online customer portal,.

Loan interest accrues daily and is charged at the policy anniversary. You will receive a bill for the interest amount. You can either pay the loan interest due or have the loan amount be increased by the interest charge if there is sufficient cash surrender value in your policy.

Should you pay off your life insurance loan?

If you no longer need cash and can start repaying the loan, you may want to make loan repayments. It’s always a good idea to at least pay the interest on the loan, due on the policy anniversary (not on the anniversary of the loan).

If you don’t pay the interest, the loan amount is increased to pay for the interest. Over time, this can have a significant impact on the cash surrender value of your policy and on the death benefit received after the insured dies.

You are not obligated to pay back the loan, which can be helpful if, for example, you use a life insurance loan as a source of income during retirement.

At the death of the insured, the death benefit will be reduced by any outstanding debt. Upon surrender of the policy, all debt will be deducted from the policy's accumulated value.

The impact of taking a life insurance loan

Over time, taking a life insurance loan has a significant impact on your policy. Remember that:

- A policy loan reduces the death benefit and the cash surrender value of your policy. The cash surrender value is the amount you receive if you cancel your permanent life insurance policy.

- Insurance deductions continue. You need to make sure there’s enough cash surrender value left in your policy to cover these costs. That might mean you must pay more premiums to keep your coverage. Failure to do so could lead to policy lapse, resulting in the loss of the policy and coverage. If that happens, there may be negative tax consequences for the loan amounts received.

Making loan repayments

Loans can be repaid at any time using the mobile app, online customer portal, or by sending in a payment.

Important: Payments intended for repaying a loan should be clearly marked as such. Otherwise, they will be considered premium payments.

Life insurance loans are different than withdrawals

When you take a life insurance loan, you borrow against the collateral in your policy, but the loan amount can continue to contribute to the accumulated value growth of your policy (for participating loans).

When you withdraw money from your life insurance policy, the money is taken from the death benefit, if the policy allows it, or from the dividends/additions to the policy (in the case of whole life insurance).

You may take withdrawals for any amount up to the cash surrender value of the policy, minus three monthly fee deductions. You can use the mobile app or online customer portal for withdrawal amounts up to $50,000.

While life insurance loans can be paid back, withdrawals are permanent and may not be paid back. In addition, you pay interest on your life insurance loan; this is not the case for withdrawals.

Life insurance loans are tax free (if the policy is not a Modified Endowment Contract). Withdrawals may be taxable.

Next steps

- Find out what is best for you and your unique situation: Work with your agent or a financial/tax professional.

- Learn about the process of taking a life insurance loan.

- Get answers to further questions about taking a life insurance loan (if you have a National Life Group life insurance policy), by contacting our Customer Experience Center.

- Initiate a loan using the mobile app or online customer portal.

- Ask your agent about converting a term policy to a permanent life insurance policy if you are interested in the potential of taking loan in the future.

- Looking to buy life insurance or an annuity? Request a call from a National Life agent.

Products issued by:

National Life Insurance Company® | Life Insurance Company of the Southwest®

National Life Group® is a trade name of National Life Insurance Company (NLIC), Montpelier, VT, Life Insurance Company of the Southwest (LSW), Addison, TX, and their affiliates. Each company of National Life Group is solely responsible for its own financial condition and contractual obligations. Life Insurance Company of the Southwest is not an authorized insurer in New York and does not conduct insurance business in New York.

TC143361(0824)3